Hello, this is John from PDFTax.com. Today, we are looking at the Form 1065 Partnership Tax Return. The form we are looking at on the screen is the official government form downloaded from the IRS website. However, it has been enhanced in a couple of ways. The first and most obvious enhancement is these green and yellow navigation buttons. If I click here, it takes me to the Cost of Goods Sold form, but I can easily get back to page one. Let's work with this form a little bit and see how it works. The first thing we need to do is input a business code number. So, we'll input "6722511" as the business code number. Now, let's go back to page one and enter a few other details. We have created a hypothetical restaurant, so we need to check a few items. We have inventory, so we will use the accrual method. Also, we have two partners, so we will include two K-1s. Now, let's input some numbers. Sales will be $750,000. If I go to the Cost of Goods Sold section, I will input $20,000 for the beginning inventory, $350 for purchases, and $135 for the cost of labor. This gives us a total of $505, but we need to subtract the inventory at the end of the year. Next, I will select the cost as my valuation method, and mark the two irrelevant questions as not applicable. Going back to page one, we have more costs to enter. Salaries and wages will be $105, and guaranteed payments to partners will be entered as essentially salary paid out to the partners for this business. On line 13, I have rent to enter, which is $60,000. These values give me $15,000 of ordinary business income. Scrolling down to...

Award-winning PDF software

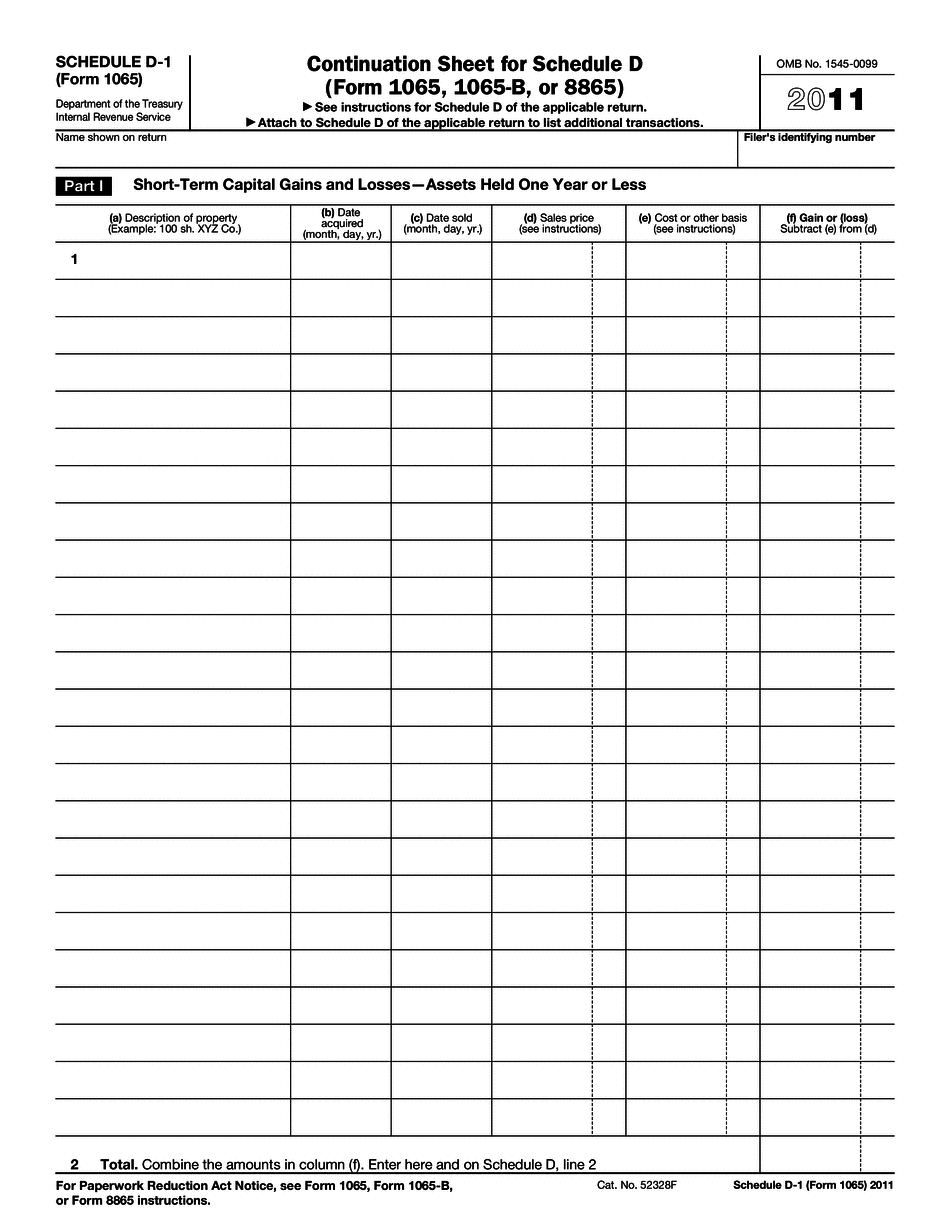

1065 - Schedule D-1 Form: What You Should Know

Please refer to the Published Publication. For information on the current version of this publication, go to Published Publication or 2021 Instructions for Form 1065—Reg info.gov If you don't receive this publication within two months, you may contact the tax practitioner or the Internal Revenue Service. The publication is not available online. Taxpayers should be aware that tax returns and tax forms filed electronically with the Internal Revenue Service are exempt from any requirements regarding the 2021 Instructions for Form 1065 Tax and Payment Due Dates, for online taxpayers. For more information, call the telephone number provided below: In Canada • • (In US/CA:) • (In Quebec and across Canada:) 2021 Form 1065—Reg info.gov This is an early release draft of a tax form, instructions, or publication, which the IRS is providing for your information. Do not file draft forms or publications with the IRS. Please refer to the Publication and the Published Publication for more information. For more information, call the telephone number provided below: For most tax situations, you do not have to file tax returns or tax forms electronically. You may complete the following forms: 2021 Publication—Reg info.gov In addition to the publication, IRS can also request a Form 1065, U.S. Return of Partnership Income, or a 1026.×. This is an early release draft of a tax form, instructions, or publication, which the IRS is providing to you. Do not file draft forms or publications with the IRS. Please refer to the Publication and the published publication for more information. For each information request, IRS will consider your circumstances, the information you provided and any other information the agency has (for instance, information from the taxpayer's return and/or Form 1040), and if there are any exceptions to the requirements to file, we'll let you know. For all requests, the agency may charge a fee. If you are not satisfied with IRS's response, you may contact the agency.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065 - Schedule D-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065 - Schedule D-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065 - Schedule D-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065 - Schedule D-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1065 - Schedule D-1