What you should know about D 1 get

- Attach to Form 1065

- Common keywords: schedule d form 1065, form 1065 schedule d, form 106 schedule d

- Form 1065 schedule d 2019 printable copy

Award-winning PDF software

How to prepare D 1 get

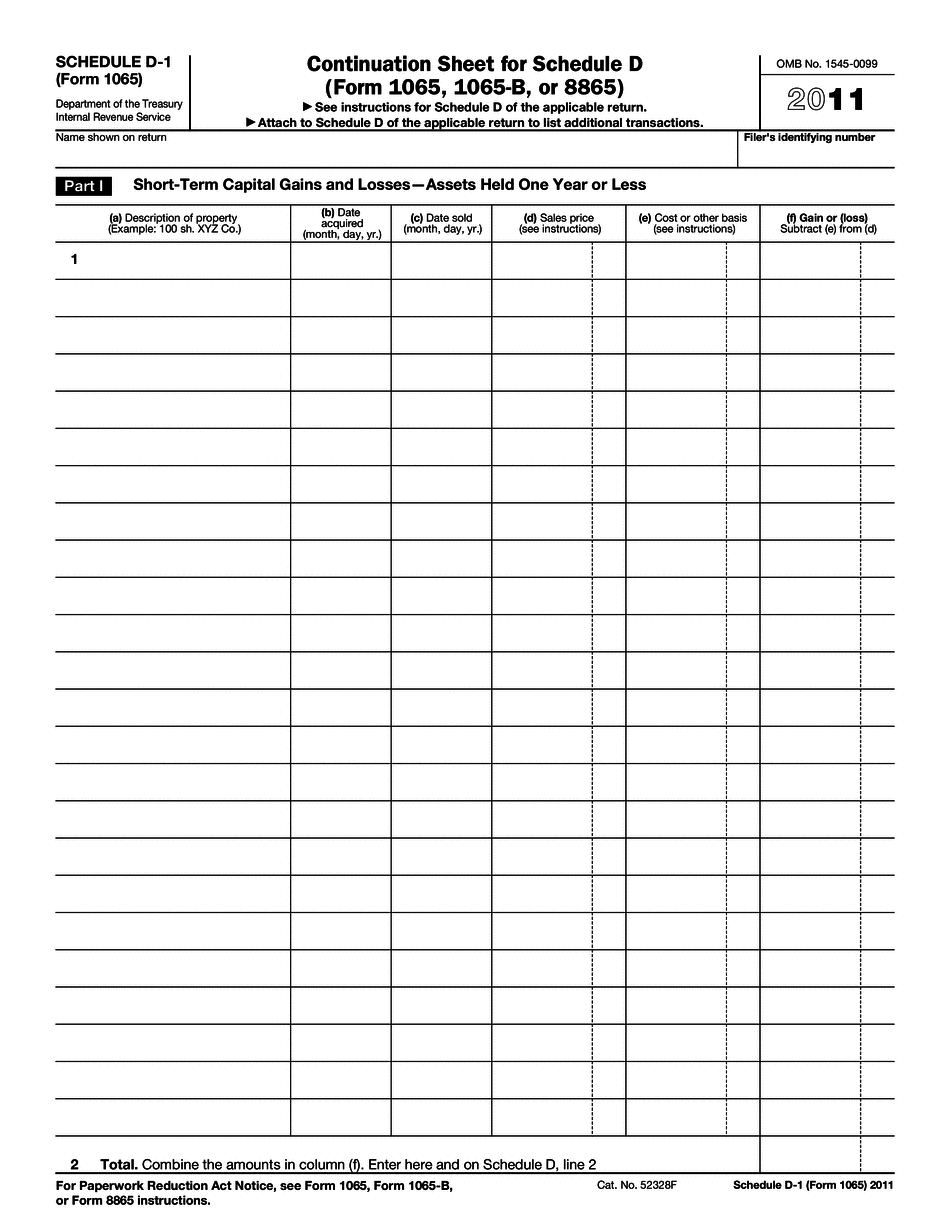

About Form 1065 - Schedule D-1

Form 1065 - Schedule D-1 is a supplementary schedule that must be completed and filed with Form 1065 by partnerships and Limited Liability Companies (LLCs) classified as partnerships. This schedule is used to report the partner's capital gains and losses and other miscellaneous items related to the sale, exchange, or disposition of certain assets. It provides detailed information about the partnership's transactions with its partners, including: - The partner's share of gains and losses from the sale of capital assets, such as real estate, stocks, and bonds. - The partner's share of gains and losses from the sale of other assets, such as partnership interests and equipment. - Information about the partner's basis in the partnership and its property. Form 1065 - Schedule D-1 is required for all partnerships and LLCs classified as partnerships, regardless of whether or not they have any capital gains or losses to report. It is used to keep track of the flow of money and other assets between partners and the partnership, and to ensure that each partner reports their share of any capital gains and losses on their individual tax returns.