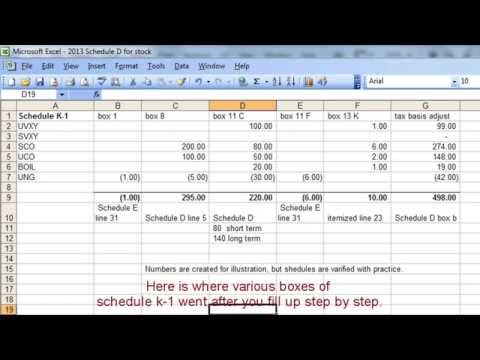

Disclaimer: This is a workaround after researching solutions suggested on the Internet. The software used in the example is TaxACT free version. The numbers are created for illustration purposes only. You need to do your own diligence and consult your tax advisor to determine how you should file. As a general rule, gains and losses for a typical ETF are reported on form 1099-B. However, there are some ETFs structured as partnerships that will issue a K-1 form 1065 when you purchase partnership ETFs. Brokers' 1099-B report the gain or loss of your investment. The schedule K-1 issued by the partnership will also report gain or loss. Both 1099-B and schedule K-1 are required to be filed. After you complete both forms, you need to adjust the tax basis in 1099-B to avoid duplication of reporting capital gain or loss on the ETF. This is a workaround that I summarized here for your reference. I use TaxACT to demonstrate step-by-step, but you need to consult your tax advisor for your own actions. Specifically, what shows in 1099-B, including gain or loss for partnership ETFs? In 1099-B, the broker will have a basis reported to the IRS. Bases not reported to the IRS in 1099-B will be provided in form 8949 by your broker. You can upload form 8949 with every transaction to the tax software, or you can enter a total for each category (A, B, or C). Here are some screens in TaxACT for a total. You also need to answer some questions in between. After you have completed all the A, B, or C categories, you report the gain or loss for your investment in partnership ETFs. At this step, the gain or loss may or may not tie to your investment gain or loss. The gain or...

Award-winning PDF software

Schedule k-1 1065 roth ira Form: What You Should Know

Schedule K-1 — IRS If a partnership owns investment property and the partnership decides not to use the property, and if the partner owns at least 10 percent of the partnership's income, loss, and proceeds from any dispositions of property, Schedule K-1 must be filed with the partner's personal tax return. 2021 Partner's Form 1065 — IRS The partnership must file this document with the. If the partnership does not need to file this form, the partnership should file Form 1065. 2021 Schedule K-1 (Form 1065) — IRS Schedule K-1 and Schedule C (Form 1065C). Schedule K-1 and Schedule C (Form 1065C) — IRS Schedule C (Form 1065C). 2021 Schedule K-1 (Form 1065) and Schedule C (Form 1065C) — IRS The partner should complete these forms with the Partner's Schedule K-1. The partnership must file these forms with the. 2021 Partner's Schedule K-1 and Schedule C (Form 1065C) — IRS Additional information about Schedule K-1. IRS Taxation Tips for Partners Filing Schedule K-1 with the Partner's Personal Tax Return You might have questions about, and concerns regarding, filing Schedule K-1 with the partner's personal tax return, even though the partner is considered to be the owner of the property or does not report an interest in the property for federal income tax purposes. If you are a small business owner and have questions about whether you should file Schedule K-1 for your partner, review the Partner's Instructions and additional information. IRS Information for Partners with Schedule K-1 Filings You can obtain additional guidance from the following sources.

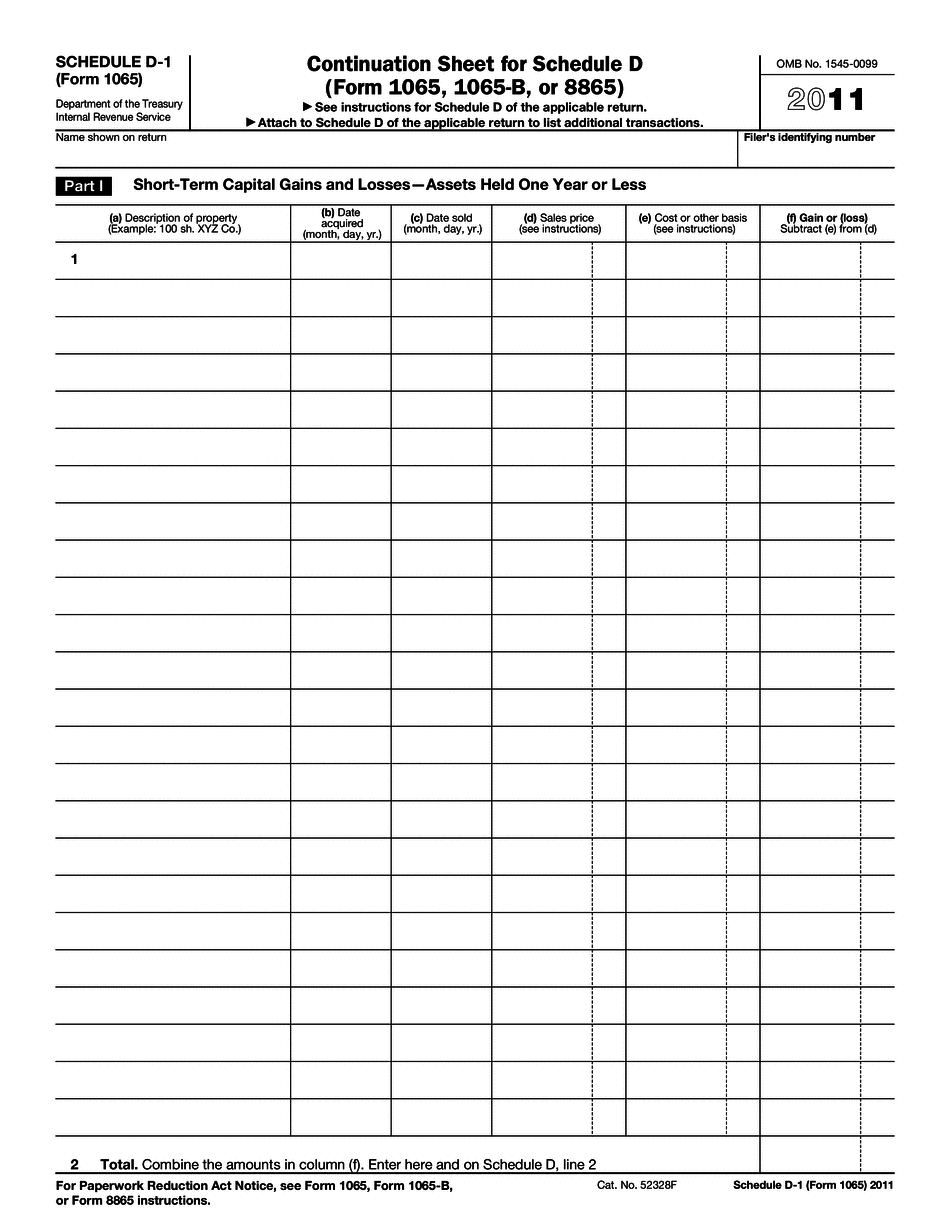

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065 - Schedule D-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065 - Schedule D-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065 - Schedule D-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065 - Schedule D-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Schedule k-1 form 1065 roth ira