Lenders have 20 questions on pastors and K-1s video number 12. The difference between an 1120 SK1 and a 1065 K-1 is that the 1120 SK1 is a pass-through form that provides information from the 1120s to the shareholders who are the owners. In the 1065, there are general partners, limited partners, LLC owners, and LLP owners. Some of the numbers on the K-1 page are used by the preparer of the next return while others are used by the recipient. Both the 1120 SK1 and the 1065 K-1 include the name of the owner, the percentage ownership, whether it's a final K-1, and indicate distributions in the form of capital to the owners. The 1065 K-1 includes additional information such as the type of ownership (general partner or limited partner), profit-loss percentage, and information on liabilities. However, the liabilities information is usually ignored as it pertains to figures from a year or two ago. The 1065 K-1 also provides a breakdown of capital, including beginning capital, capital contributed, income or losses, and distributions, as well as guarantee payments for partners or LLC owners. The 1120 SK1 does not require the inclusion of wages as they are recorded on the 1040 form. The 1065 K-1 specifies the amount of cash and property distributed, while the 1120 SK1 only provides the total distribution amount without the breakdown. Additionally, the 1120s has a line for repayment of loans from shareholders, which is considered cash flow to the owner. Whether this line is counted or not depends on individual guidelines.

Award-winning PDF software

How to read a k1 1065 Form: What You Should Know

USG AAP 2.1.1-1.pdf. Tax and other questions for partners from E.g., Schedule K-1 and K-1 (Form 1065) and 1065 partners return Nov 14, 2024 — This is the 1065 partnership return for your 2024 taxable year. This is an overview or the tax form that is filed by a sole proprietors, partnership, S corporation, C corporation, as well as partnership income tax return. 1065 Tax Release — Schedule K-1 Schedule K-1 (Form 1065) Return and Form 1065 Apr 14, 2018– Schedule K-1 (Form 1065) for your 2024 taxable year. This report is for the 2024 taxable year. 1065 Tax Release — Schedule K-1 for 2024 and prior years from a USG AAP Partner or USG AAP Shareholder Schedule K-1 or 1065 This is a complete summary of Schedule K-1 or 1065 as described below. This is not a tax form. It is a tax guide to help you understand your partnership return and the partner's tax report. The tax return is a source document that is the basis for the partnership return and the partner's tax return. Schedule K-1 & 590 — Schedule K-1 (Form 1065) with Income from a Foreign Partnership Taxpayer's Report for Partnership Income Tax return for 2014, 2015, 2016, 2017 K-1 tax forms and Form 1065 partner's return April 14, 2018– The K-1 tax form for a partnership is Form 1065 (or 1065NR). The partner's income tax return (Form 1065) is a report or a schedule filed by the partnership (or partnership interests) on Form 1065. K-1 partners return — tax information and Form 1065 partner's return Schedule K-1 — partner's income tax return Nov 14, 2022-- This report is for the 2024 taxable year. It is a summary or the tax form that is filed by a partnership in 2017.

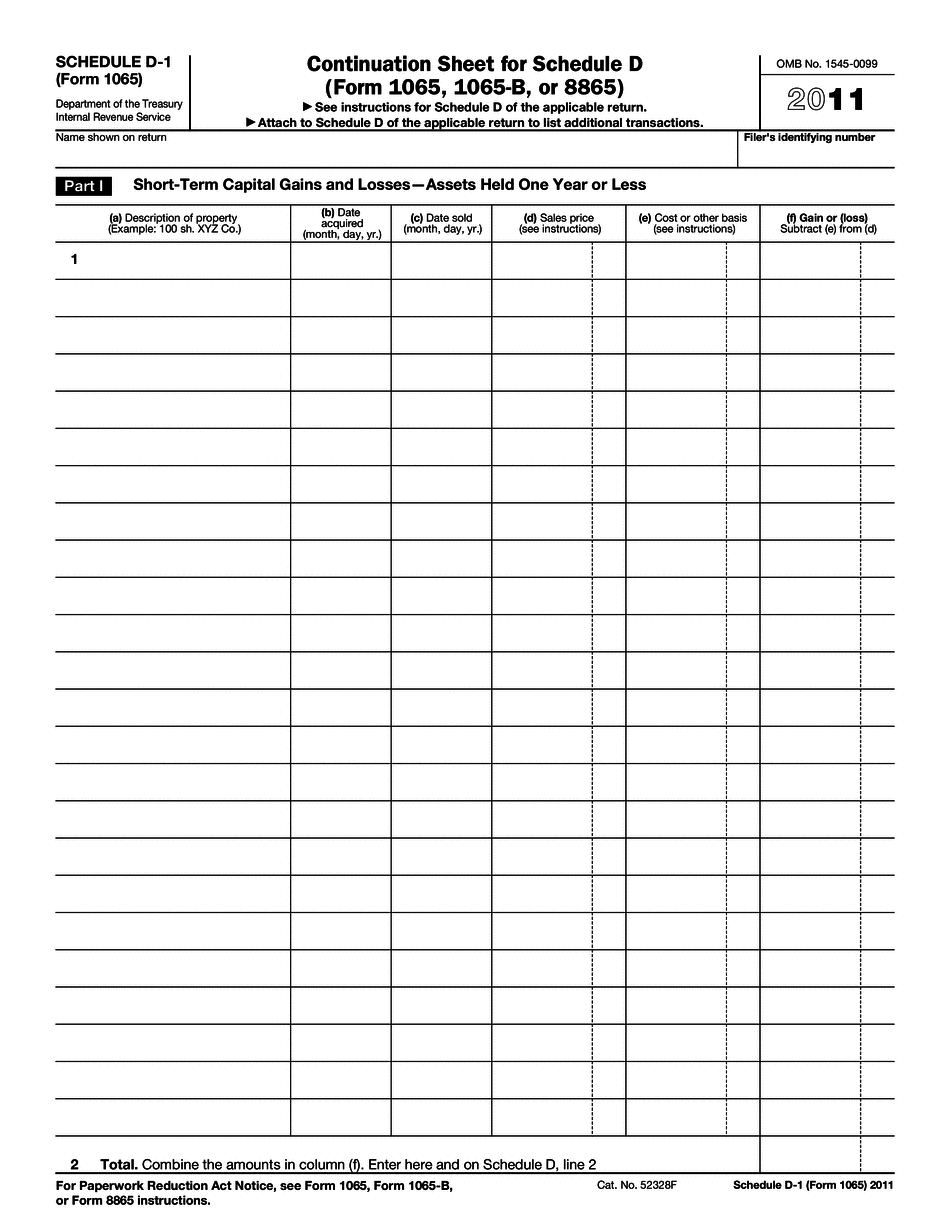

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065 - Schedule D-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065 - Schedule D-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065 - Schedule D-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065 - Schedule D-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to read a k1 1065