Hi, fools! I'm Joel South, an energy analyst. We're continuing with our "Ask a Fool" series, and today Jerry asks, "What is your opinion of pipeline MLPs in an IRA up to the IRS limit?" Jerry, that's a very good question. MLPs (Master Limited Partnerships) are really a growing field. The reason is they offer very nice distributions, especially in a low interest rate environment. These are really growing in popularity. In the past, companies or investors would really look at utilities for this investment. But with MLPs offering 6% or even higher distribution yields, it's really growing in popularity. If you look at companies like Energy Transfer Partners and Enbridge Energy Partners, for example, they offer 7.8% and 7.4% annualized yields, respectively. So, they offer great yields. But how much should you put in an IRA? The answer to that question would be as little as possible. The reason is IRAs already offer a tax break, and MLPs, in their very nature, do the same. They basically are a return of capital and skip corporate taxation. So, they're usually not taxed until sold, very similar to what the IRA does. You're not actually taxed until you reach retirement and sell. The second issue you want to look at is what they call a UBTI (Unrelated Business Taxable Income). This is rarely a problem, especially if you're investing under the IRS limit. It usually affects larger unit holders. Basically, with an IRA, you have to pay tax on income that's not related to the purposes of the IRA, which is tax exemption and putting away until retirement. MLPs are like owning a business, so the return of capital is like getting income from an employer. Since it's not part of your retirement per se through the rules, you can be taxed...

Award-winning PDF software

Mlp in roth ira Form: What You Should Know

MPP when distributed, called the nondeductible portion of capital gain, or GDD Annual Distributions — Individual Retirement Arrangements Each year, your IRA will need to complete its Individual Retirement Arrangements (“IRA #0”) Form 8939. Then your account will calculate the amount required to be removed from your balance to pay your taxes, just like if a paycheck or a withdrawal was received from your IRA. You have to wait until the IRA is sent into collections to pay the tax, but when the IRS removes the money, all the income and tax owed for the year will be paid back to you automatically. When Do I Send My Form 4938 to My IRA Custodian? — If All Things Are Equal Your IRA must send your Form 4938 to your custodian by April 15th to prepare for your tax liability. IRA Tax Exemptions — Federal Tax If it's a Roth, Roth IRA, or Individual Retirement Arrangement (IRA) you're building, then you're paying no tax on the investment income. However, if you are a non-Traditional IRA holder, your taxable income may be taxed as follows [PDF] If you're in a Traditional IRA, the amount you are receiving is taxed as ordinary income and not as capital gains. To get the tax refund you are entitled to, you have to fill out and send in IRS Form 8606. You will receive 263.53. The IRS also will withhold 12.5% of this income from your paychecks without paying any additional tax. If your taxable income is 600 or less, then you will have to file IRS Form 5329 to claim the rebate. IRA Qualified Plans -- Federal Tax Unlike 401(k) plans, which only pay a tax rate of 13.3% when it's withdrawn, an IRA also gets tax credits for qualified retirement plans (Rps), but only if the amount received goes over 100. Here are the credits the IRA can claim: Qualified Retiree Medical Deduction This is based on the IRS' This is based on the IRS' “Actuarial Bulletin” from September 1, 2010. This would allow the IRA to This is based on the IRS' “Actuarial Bulletin” from September 1, 2010.

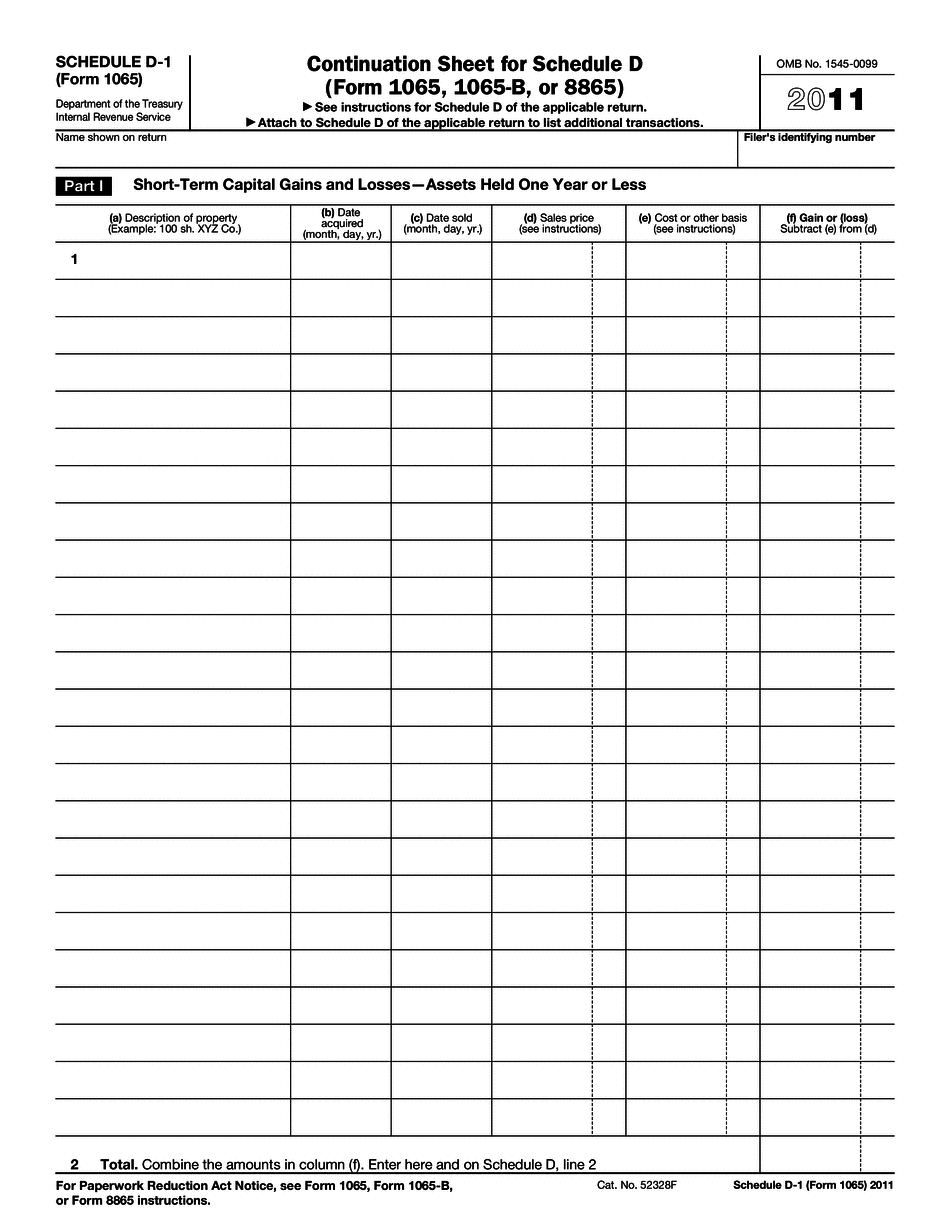

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065 - Schedule D-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065 - Schedule D-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065 - Schedule D-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065 - Schedule D-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Mlp in roth ira