Lenders have 20 questions regarding pastors and K ones video 3 that K1 passed through income or loss items. - You can find the LLC's partnerships and escorts that are flowing through to the 1040 on Schedule E page 2. - K1 pass-through can also be seen on Schedule B and as capital gains on Schedule D. - When dealing with pass-through entities, there are always three members involved. - On the personal side, taxable income listed on the back of E and elsewhere or actual cash flow from a k1 are included. - The video series will explain the formula for determining cash flow and how to calculate cash flow available. - The taxable income figures on the 1040 are never cash flow, regardless of the schedule they are found on. - Lenders have to choose between actual cash flow and available cash flow when determining a person's share. - In future videos, the process of making this choice will be explained, as well as how to calculate it. - If you enjoyed this information and want to receive all 20 free videos, along with a copy of the tax return analysis quick reference guide, visit the URL provided.

Award-winning PDF software

Where to report k1 income on 1040 Form: What You Should Know

The “K” is for “Know.” You need to know what is happening with Schedule K-1 before you can fill out it. When is a Schedule K-1 Tax Return Required to Be Filed? It's been over 30 years since Congress decided that you shouldn't file a Schedule K-1 unless and until both spouses have income that is over the exemption amounts. The following items must be reported on a Schedule K-1: The spouse making the contribution, the beneficiary, owners, and shareholders of any business or income producing property you own or have the right to vote over which you have an ownership interest; The business partner (other than a dependent) that is the recipient or owner of any qualified dividends or qualified stock distributions from the business; The qualified relocation expenses from an individual retirement plan if you have the benefit of using the same type of plan from one employer and another employer; A trust or annuitant under a trust, including a spouse or beneficiary of the trust and another trust or annuitant of the trust; Any payment of income or social security benefits received directly or indirectly by an individual or a spouse or dependent of an individual where the payment is based on a change in the net income of the individual for whom the payment (to the extent the taxpayer is a member of either of two classes of taxpayers, the married filing jointly class or individuals filing a head of household). The following items are the exceptions to the rule from the 30-year period: A taxpayer or spouse is an employee of 1 or more corporations if that taxpayer had the right to elect to be treated as an employee of only 1 corporation. For an employee to be a nonresident alien, the taxpayer must control at all times a partnership, S corporation, trust, estate, or other entity in which at least 50 percent of the partnership, S corporation, trust, estates, or other entity's taxable income is from sources within the United States and not from profits or gains of a foreign corporation. Example: When a taxpayer owns stock of one corporation and is also a United States resident, such taxpayer is not required to file a Schedule K-1 for that year. Example: When a taxpayer owns stock of one corporation, has the right to vote shares that are owned for him by a trust, and has an interest in another entity controlled by the trust, that taxpayer is required to file a Schedule K-1 for that year.

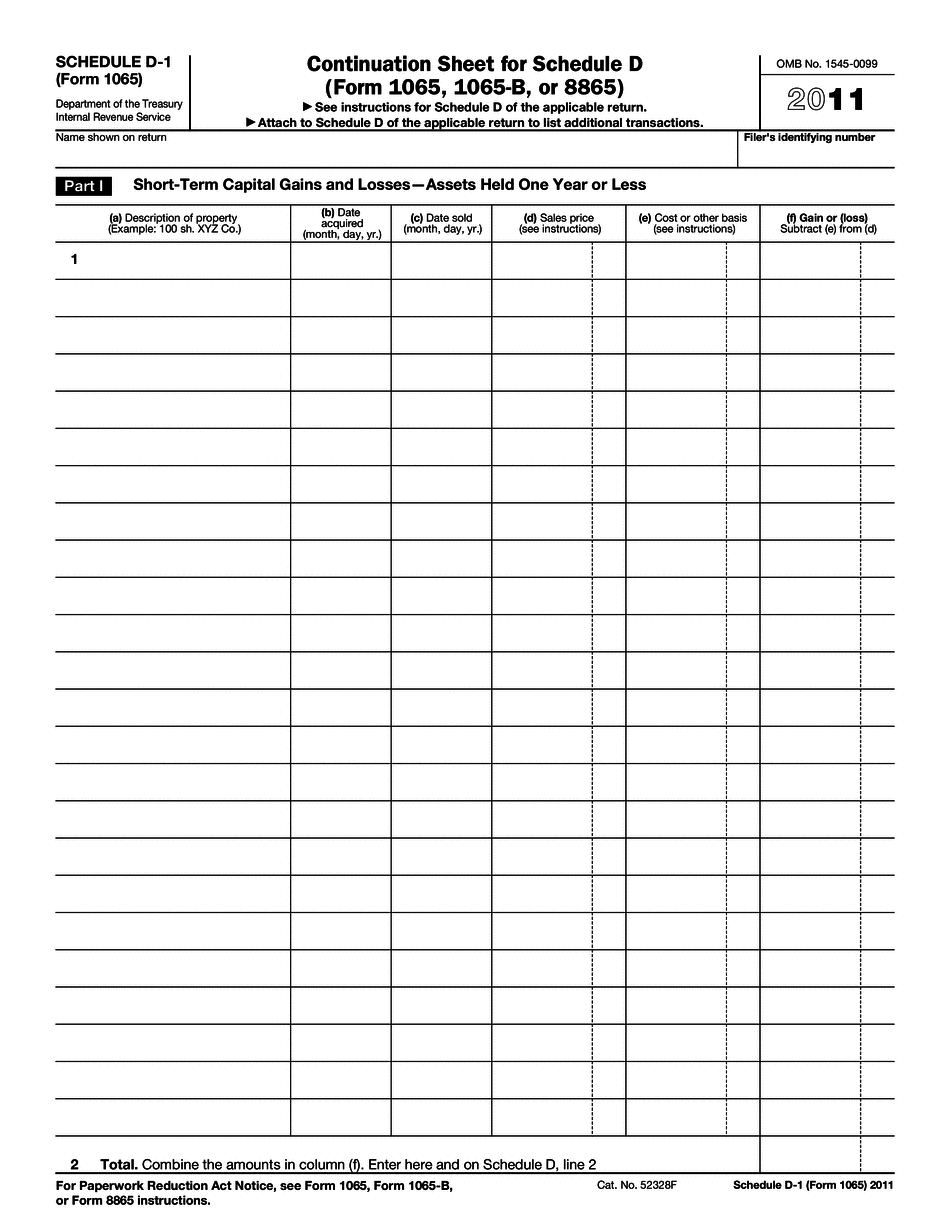

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065 - Schedule D-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065 - Schedule D-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065 - Schedule D-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065 - Schedule D-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Where to report k1 income on 1040