Award-winning PDF software

Ubti on k-1 Form: What You Should Know

TIP 2. If a partnership fails to report or compute BTI for a self-directed IRA, the partnership will have an unreported passive activity that is subject to penalties, interest, interest tax, dividends, and a nondeductible tax deduction. Taxing the Income of a Limited Liability Company (LLC) The IRS has developed guidelines on the manner for calculating passive activity in a partnership. The guidelines define passive activity as a transaction between a limited liability company and a related person or entity involving the use of active management In addition to the guidelines, the IRS has issued guidelines on the treatment of limited partnerships in the income tax and the treatment of “Qualified Passive Activity Incentive Plan (PAID)”: PAID is only for partnerships engaged in business of providing taxable services and the provision of a portion of those services to a taxable entity. As a general rule, PAID is for partnerships engaged in a business of providing taxable services; it could not be used to calculate the net income of a partnership. You are advised to contact the entity you have invested in. If the agreement provides (by contract or agreement) that the partnership is required to disclose taxable activity and do so There are a limited number of IRS-recognized PAID agreements for limited partnerships (that are considered tax-sheltered) that are also used as the basis for calculating BTI: PAID — UnitedHealth Group : This is a contract providing for a PAID between the Limited Liability Company and a qualified organization engaged in the business of providing healthcare professional services. PAID — UnitedHealth Services, Inc. : This PAID agreement provides, for use by its qualified charitable trust, for qualified charities to invest in one another's financial, business, or investment assets. PAID — UnitedHealth Group : This PAID agreement is a qualified charitable trust that will be used as the basis for calculating taxable income of UnitedHealth Group (“NHS”) over the life of this related party contract with a qualified charity. Note : There are more PAID agreements with respect to UnitedHealth than qualified charities. Therefore, to minimize the loss of any deductions incurred by a PAID organization, it is recommended that the PAID agreement be used to determine each entity's base year income for purposes of calculating BTI. Qualified Charitable Trusts are a different entity.

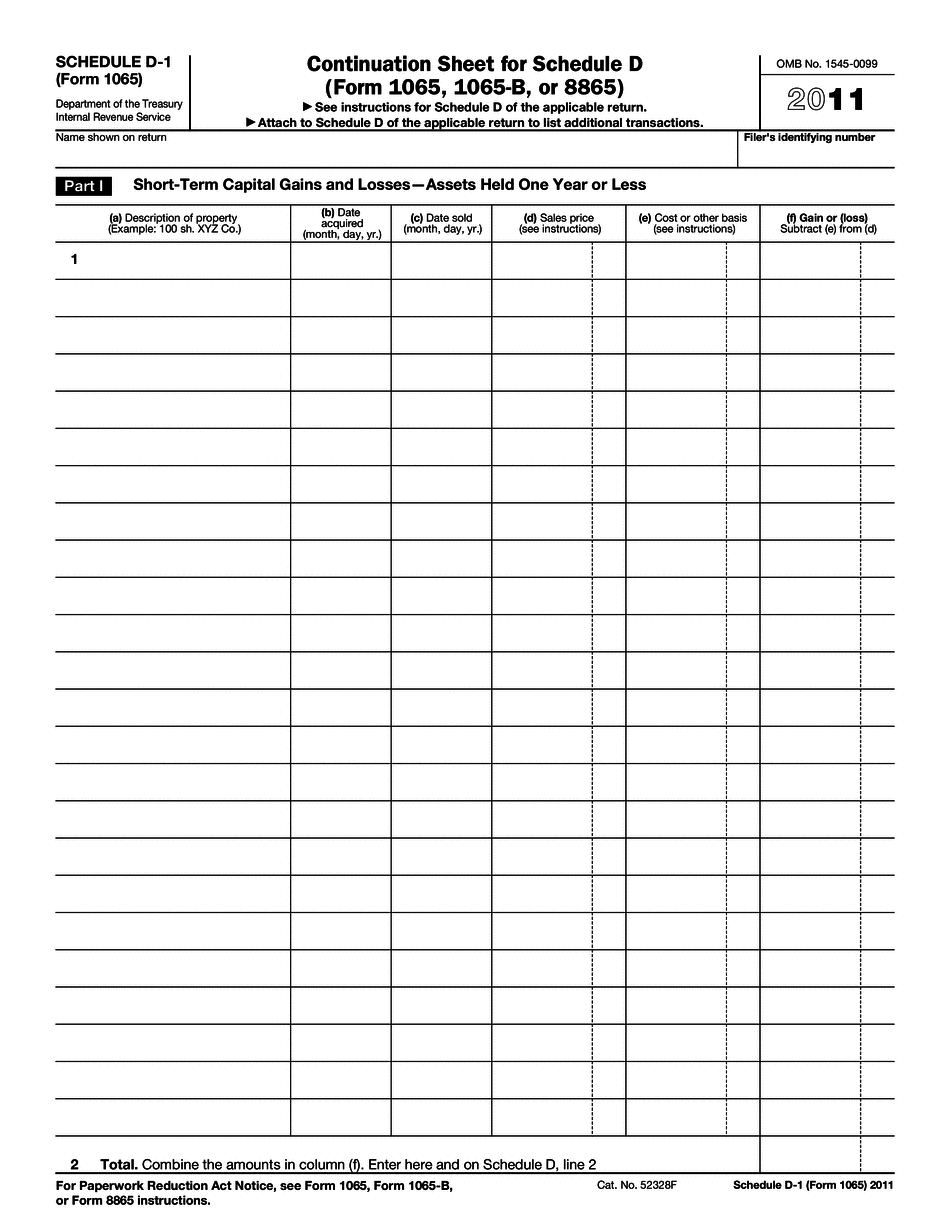

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065 - Schedule D-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065 - Schedule D-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065 - Schedule D-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065 - Schedule D-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.