I'm an antenna bergman. I'm a partner with the Irish Financial Group, president of the IRA Financial Trust Company. Today, I want to discuss BTI (Unrelated Business Taxable Income) and real estate transactions. It's a popular combination, and I get a lot of clients who do real estate and want to use leverage or loans to enhance their IRA purchases. The question of unrelated business taxable income pops up. Why does unrelated business taxable income get triggered in three ways? Number one, using marginal buy stock. Number two, a non-recourse loan to buy real estate. There's an interesting exemption under 514(c)(9) for 401ks. If you use a 401k to obtain a non-recourse loan for real estate, you wouldn't have to deal with UBTI and its 39.6% tax. The third way is by investing in an active trader business, such as an LLC partnership with an IRA or a 401k. So, for example, if you use a non-recourse loan to buy real estate in an IRA, put $100,000 of your own money and got a loan of $100,000 from a non-recourse lender or bank, 50% of the profits or gains associated with that deal could be subject to UBTI, and the tax rate goes up to 39.6%. This tax is reported on Form 990-T, a tax that an IRA pays but may not have otherwise had to pay if stocks or mutual funds were bought or leverage wasn't used. Most people expect their IRA to generate tax-deferred or tax-free income, especially with Roth or Solo 401k. So, the additional tax is not something that many taxpayers or IRA holders want to deal with. It changes the deal for a lot of people. There's a video idea on how to avoid it if possible, such as using a C-Corp blocker or a lending transaction, or...

Award-winning PDF software

Ubti in roth ira Form: What You Should Know

Organization Business Income Tax Return) when the gross amount equals or exceeds 600,000.

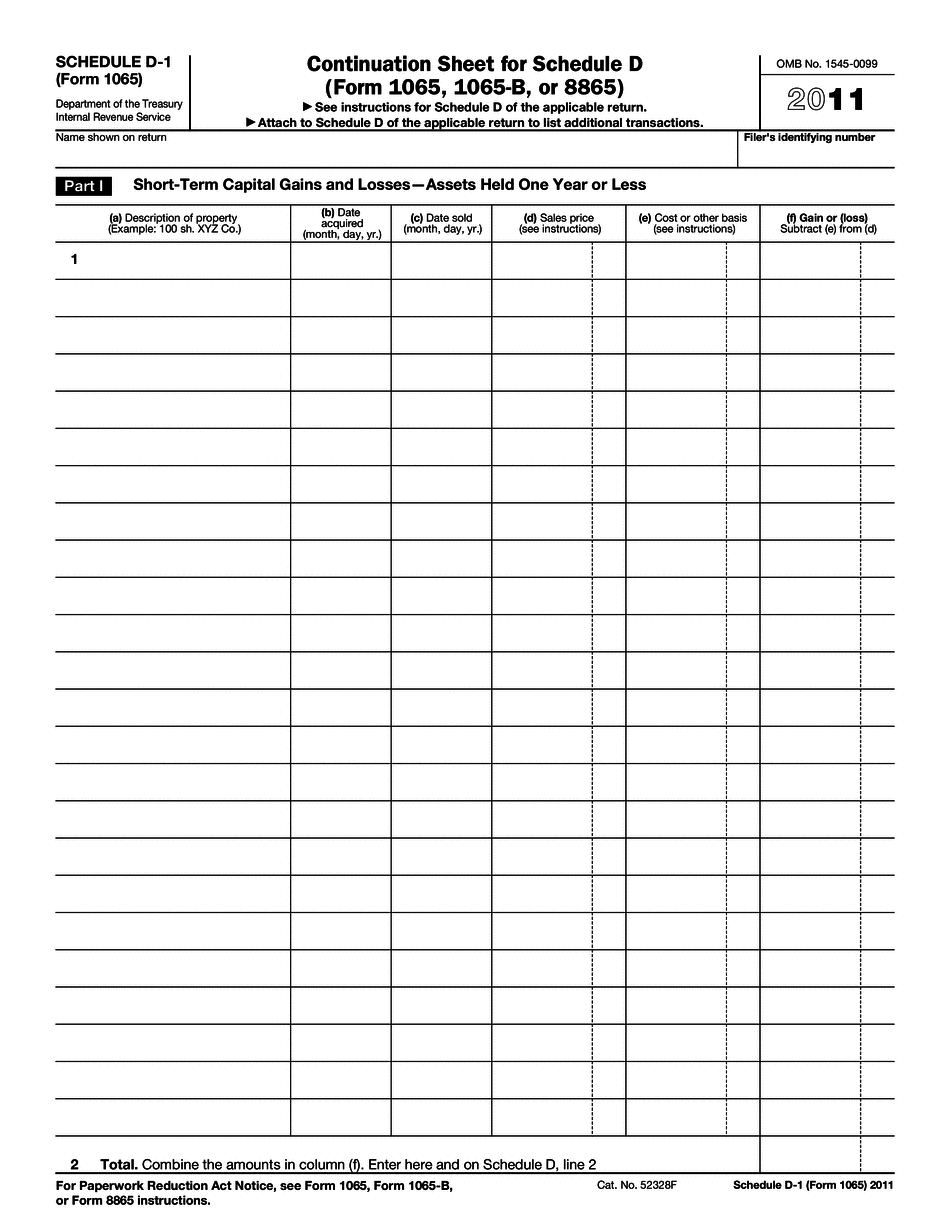

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065 - Schedule D-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065 - Schedule D-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065 - Schedule D-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065 - Schedule D-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Ubti in roth ira