Award-winning PDF software

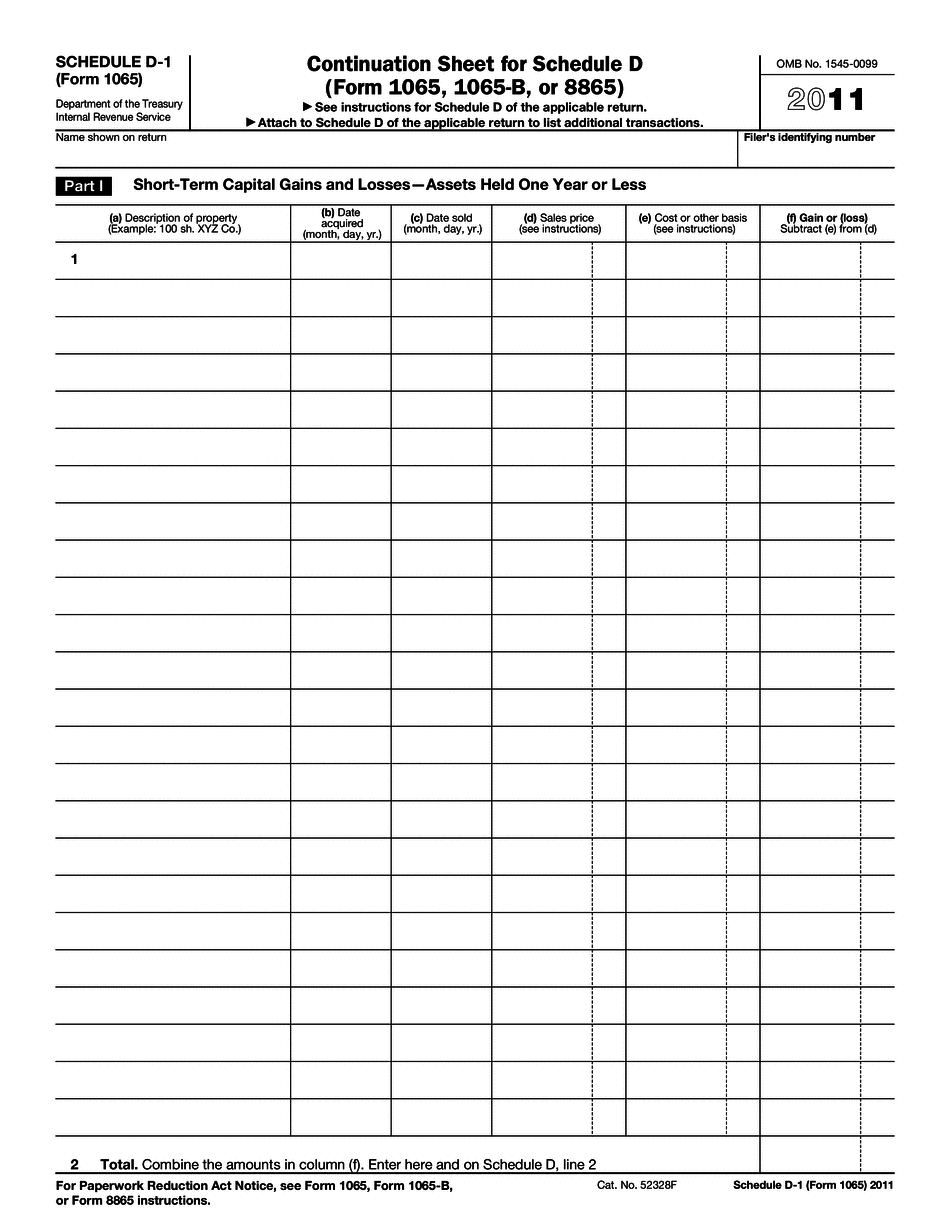

Form 1065 - Schedule D-1 Birmingham Alabama: What You Should Know

PUBLIC SCHOOLS. PUBLIC LIBRARIES. K-12 EDUCATION, ETC. The Community Foundation of Greater Birmingham, 501(C)(3) provides a dynamic and effective means for sustaining economic justice by enabling local volunteers, private donors, and the public to contribute financial support to the efforts of The Community Foundation to enhance our local economy. The Community Foundation of Greater Birmingham serves as a key community resource that provides both the financial resources necessary to achieve our goals, and the opportunities, resources, and knowledge to develop our community. The Foundation seeks to develop and increase opportunities and provide a network of financial support and community services that are specifically targeted to disadvantaged students. The Community Foundation of Greater Birmingham (CFB) is a not-for-profit, tax-exempt educational non-profit organization, established in 2024 as a national organization (see). The purpose of our organization is to increase school readiness and achievement, improve academic achievement among students of varying backgrounds and abilities, and encourage the pursuit and attainment of higher education. 2024 Form 990 Schedule D (Form 1065). 2024 Schedule K‑1 (Form 1065). The Community Foundation of Greater Birmingham is not-for-profit as defined in Internal Revenue Code Section 501(c)(3). The charitable tax identification number (“CHAN”) for this organization is 75-078715. Our mailing address is 3315 Pinion Road West, Suite 200, Birmingham, Ala., 35206. We can mail your document by regular mail or certified mail, and we can fax or email your document. For other questions, please telephone (205) 727‑7076. 2024 Schedule K‑1 (Form 1065/Form 970). MONEY TO BE PAID BY THE AMERICAN RESIDENTS AND THEIR CUSTOMERS OF THE COMMUNITY FOUNDATION OF GREATER BIRMINGHAM FOR THE YEAR 2018: The Community Foundation of Greater Birmingham is authorized by law to levy annually a tax of one per cent on income or gain derived, directly or indirectly, from the investment and management of the Community Foundation's property holdings. (U.S.C.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065 - Schedule D-1 Birmingham Alabama, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065 - Schedule D-1 Birmingham Alabama?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065 - Schedule D-1 Birmingham Alabama aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065 - Schedule D-1 Birmingham Alabama from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.