Award-winning PDF software

Form 1065 - Schedule D-1 for Burbank California: What You Should Know

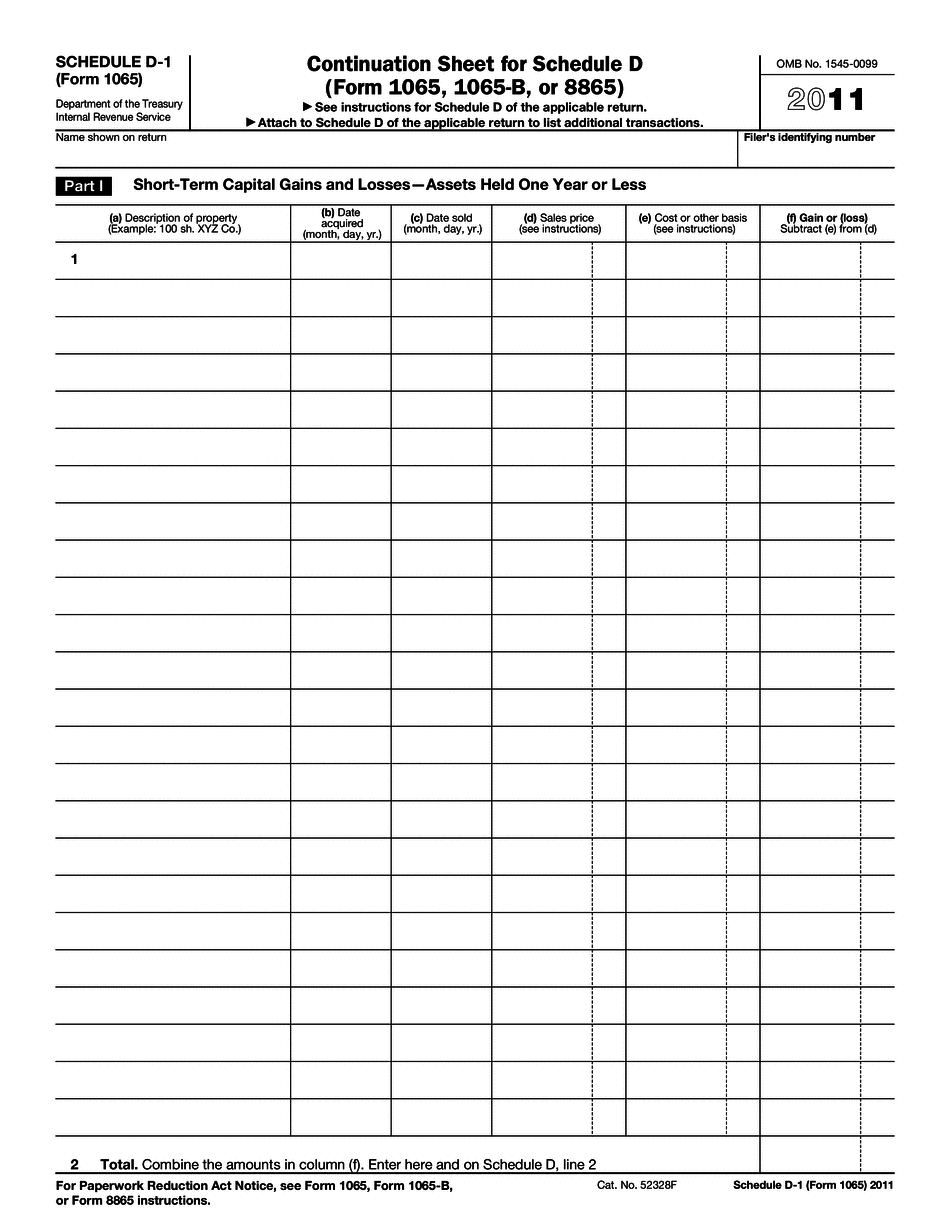

If applicable.) CALIFORNIA SHORT-TERM capital gains: • Non-business owners' loss amounts from the sale or exchange of personal property. • Sale or exchange of depreciable property to the extent the capital gain from the sale or exchange exceeds the depreciation deduction or limitation provided in Sections 1 and 2. • Non-business owners' loss amounts from sales of businesses or farm crops, the sale of which occurs when the value of these items exceeds the total of the current fair market value and long-term costs, and the cost of the sales proceeds to the seller. Nonbusiness owners' gain or loss from sales of depreciable property subject to California taxation is subject to the following limitations and exceptions: • Sales of property of any person other than a long-term resident of California and in which the tax is less than one percent of the fair market value. • Sales of property to which Section 6001 applies because of the provisions of Section 6100 or a comparable state law. (Note: Section 6010 provides an exception to the limitations in this Section.) • Sales of property by certain nonprofit organizations. • Sales of residential mobile home units if the sale or exchange occurs on a casualty or theft loss or a capital loss from the sale or exchange of property subject to Section 1001. Non-business owners' gain from the sale or exchange of any property subject to California taxation is subject to the following limitations, exceptions, and conditions. • If all or part of a business asset is transferred to an organization that is not a qualified organization by reason of Section 501(c)(6), the business asset will be considered to be owned by the transferor organization, and thus its California basis for federal property tax purposes will be zero. (See below.) • If the business transferor organization provides that any nonbusiness owner of the property will be required to account for gain or loss thereon in the manner prescribed by state and local tax law, any nonbusiness owners' gain or loss from the sale or exchange of the property is subject to California taxation even though it is attributable to the sale or exchange of property subject to Section 1 and not to other types of income.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065 - Schedule D-1 for Burbank California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065 - Schedule D-1 for Burbank California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065 - Schedule D-1 for Burbank California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065 - Schedule D-1 for Burbank California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.