Award-winning PDF software

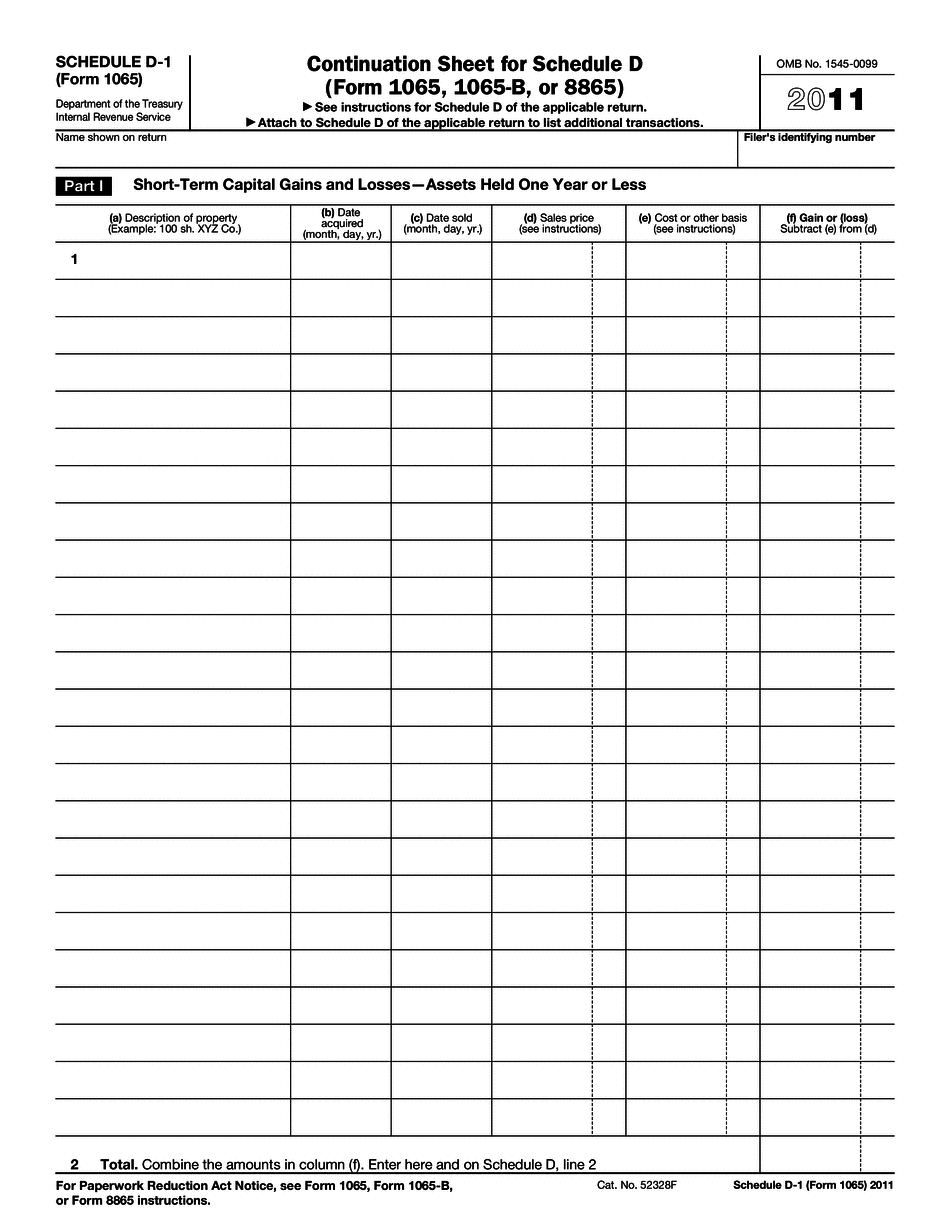

Greensboro North Carolina online Form 1065 - Schedule D-1: What You Should Know

To receive an email update on the agenda contact Jill at. The tax deadline is Friday, October 21. You have until midnight on that day to file your return. For more information about the Greensboro Municipal Services District, call 404.296.2482 or visit us online Greensboro, NC | Home The City has added a new service to its website called Zoom, On this site, you can find your monthly property tax bill. Greensboro, NC | Home The Town of Greensboro has added a new page with information on the new tax rates. Greensboro, NC | Home The Town of Greensboro recently adopted legislation that increases the standard commercial tax rate from 5% to 8%, effective September 1, 2014, with an annual percentage rate cap of 1,500,000. The rate increase is retroactive to June 1, 2014. The following is a summary of the changes to the Commercial Tax Rate: The business tax rate for all new businesses will increase to 6%. The rate for new commercial structures will increase from 3.5% to 4.5%. The business tax rate for existing businesses will increase from 5% to 6%. The business tax rate for new residential structures will increase from 5.5% to 7.5%. The business tax rate for existing residential structures will increase from 5% to 6.25%. The average amount of tax paid on annual businesses in the Town increased from about 2,320 to 2,460 in 2014. In addition, the average amount of tax paid on all residential properties increased from about 1,550 to 1,610. The Town's average number of commercial premises increased from 2,350 to 2,425. The total number of commercial businesses in the Town grew from 3,300 to 3,340 and to 3,360 from 3,210. For residential properties, the Town's average number of residential premises increased from 1,930 to 1,930 and to 2,060 from 2,040. The total number of residential premises in the town grew from 1,670 to 1,740 and to 1,940 from 1,790. In 2014, the Town collected 12 million in commercial taxes. See the Summary of Changes to Commercial Tax Rates for other details. The above amounts have been adjusted for the change in the number of businesses because of the new standard commercial tax rate.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Greensboro North Carolina online Form 1065 - Schedule D-1, keep away from glitches and furnish it inside a timely method:

How to complete a Greensboro North Carolina online Form 1065 - Schedule D-1?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Greensboro North Carolina online Form 1065 - Schedule D-1 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Greensboro North Carolina online Form 1065 - Schedule D-1 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.