Award-winning PDF software

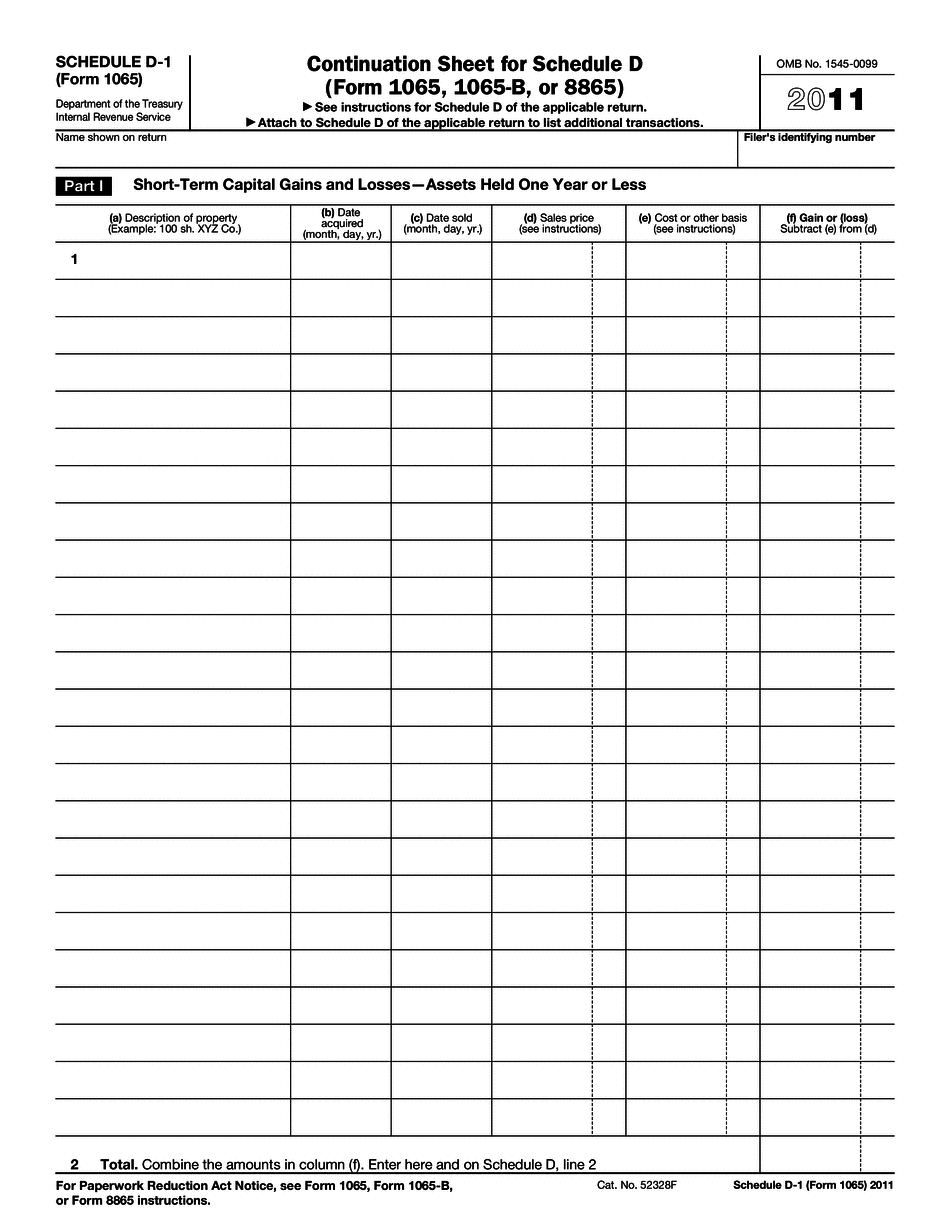

Printable Form 1065 - Schedule D-1 Visalia California: What You Should Know

Printable Form 1065 (Schedule A-10) Santa Barbara California — Fill Printable Form 1065 (Schedule A-10) Santa Barbara California. Modify the PDF form template to get a document required in your city. Then just send it to the IRS! Form 1065 The form you use affects the way you report and the amount of taxes you get to pay. Make sure the form is correct and complete, but remember to complete and send it as soon as you get the necessary information. Be sure to consult a tax lawyer or tax experience expert! Important note before you make a decision First, do your due diligence. Make sure the form you use has all the information and information the tax preparer needs. Ask if you need to fill out additional information. If you are unsure, get the information you need by calling the IRS, the agent at TaxAct.com, or by going to a library or academics. You won't regret your research. Tax preparers get paid by the minute. The most they make is 30-40 an hour and are doing a thankless job. If you don't do your research, you could end up writing a lot of paper work that could come back to bite you. Your preparation could be delayed for weeks. It can take one day for a tax attorney or expert to determine what tax issues you might be facing in this county. You need to do your due diligence and decide what is most important to you. This isn't an all-in-one service. There are a lot of options, and you need to do your homework. Make sure it is the right tax tool for you. How to pay the taxes on your U.S. partnership income You must submit a U.S. financial disclosure. You can fill it out online by using this free tool: U.S. 1040 Financial Disclosure (Forms 1040-ES and 1040-PF). Your partnership should submit a 1099 -Form 1099A at the end of each year to the IRS. You report your income and gain through Schedule B (Form 1065) or a Schedule C (Form 1065). If you do not receive a 1099-A from your reporting partner during the year, check with that partner. Check with the agent at TaxA ct.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1065 - Schedule D-1 Visalia California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1065 - Schedule D-1 Visalia California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1065 - Schedule D-1 Visalia California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1065 - Schedule D-1 Visalia California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.