Award-winning PDF software

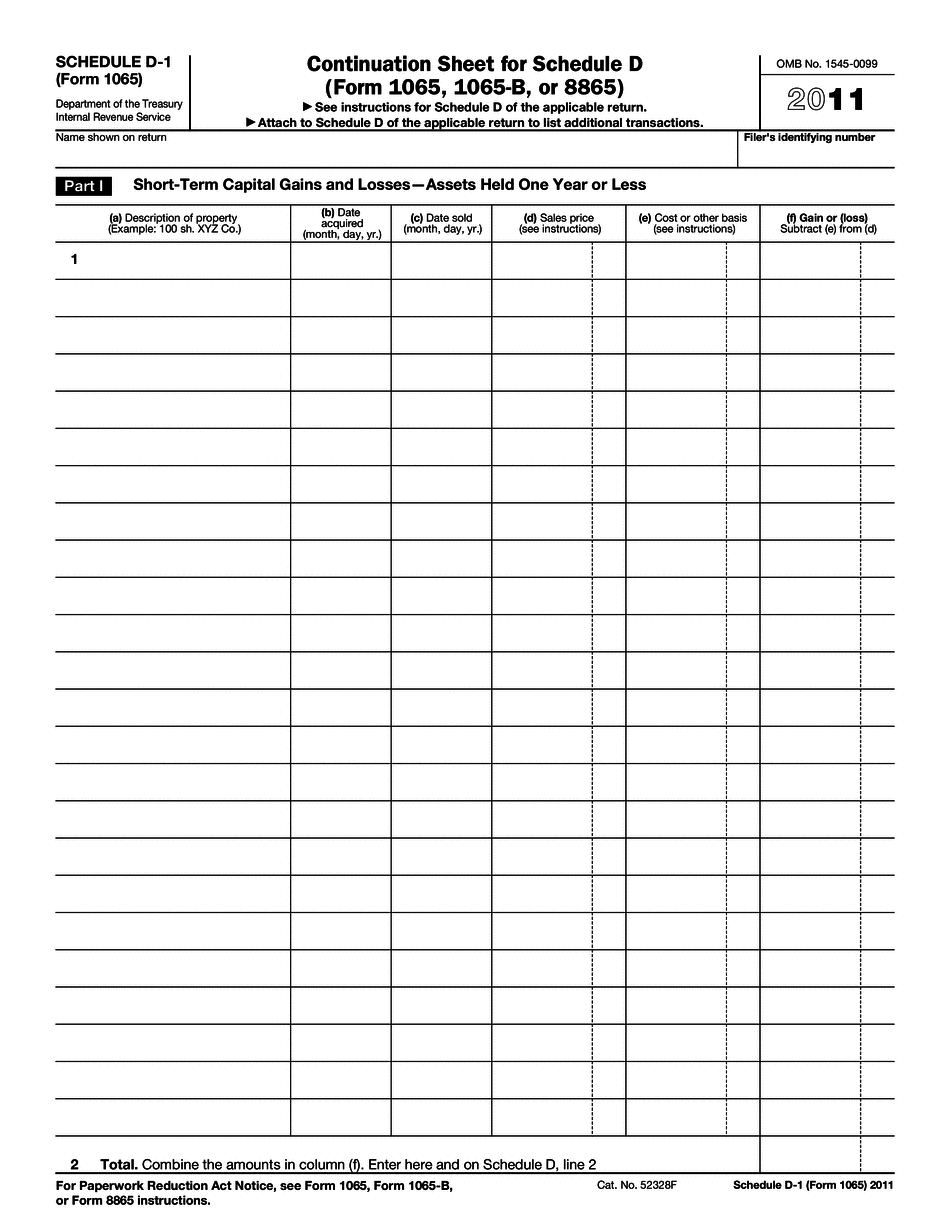

Vista California online Form 1065 - Schedule D-1: What You Should Know

See instructions there for 2017 Schedule D-19, Other than Distributions, Report of Income of Partnerships, Partnerships for Which a Partner SECTION 2: Evaluating Partners' Income SECTION 3: Reporting the Payments from Partnerships Section 3: Reporting the Payments From Partnerships Part II. Capital Gains and Losses—Capital Gains from Business or Investment Activities. Chapter 4, Sections 2, 4: Evaluating Capital Gains by Income Level. FACTORS TO BE CONSIDERED IN DETERMINING RESIDUAL INCOME. (1) GENERAL. If you are a nonresident alien individual, you cannot claim the regular graduated rate of tax imposed by sections 18 and 13; therefore your net capital gain shall be 0. Section 1372 allows for an unlimited exclusion of capital gains from income for the foreign earned income exclusion. Section 1453 (relating to qualified farm income) and section 1471 (relating to qualified dividends and qualified other income) provide reduced rates of tax on gains from long-term capital gains for domestic taxpayers. (2) AMOUNT OF GAIN. When determining the amount of gain realized, you should calculate it as follows. If the net capital gain is more than 25,000 (100,000 if married and filing separately) for you and your spouse, use the total of the net capital gains of both of you. Otherwise, use the lessor's amount. For this purpose, the lessor's amount is the amount of the adjusted basis, the gain on disposal, and any unrealized appreciation on a capital asset held more than 1 year. (3) CURRENT VALUE. For purposes of applying the dollar limit under section 1374(a)(2), the last year of the 5 taxable years before the effective date of this section or section 1374(a)(1), whichever is later, is the current year. The rules of section 1374(a)(1) do not change when calculating the current year value of the gain. (4) QUALIFIED DEBT. For purposes of section 1421(a)(1)(B), the cost basis of qualified mortgage debt shall be determined using the adjusted basis of your property, as reduced by any property of which you are or were a creditor at the end of the year of acquisition. (5) FACTORS INFLATION REQUIRED.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Vista California online Form 1065 - Schedule D-1, keep away from glitches and furnish it inside a timely method:

How to complete a Vista California online Form 1065 - Schedule D-1?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Vista California online Form 1065 - Schedule D-1 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Vista California online Form 1065 - Schedule D-1 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.