Award-winning PDF software

King Washington Form 1065 - Schedule D-1: What You Should Know

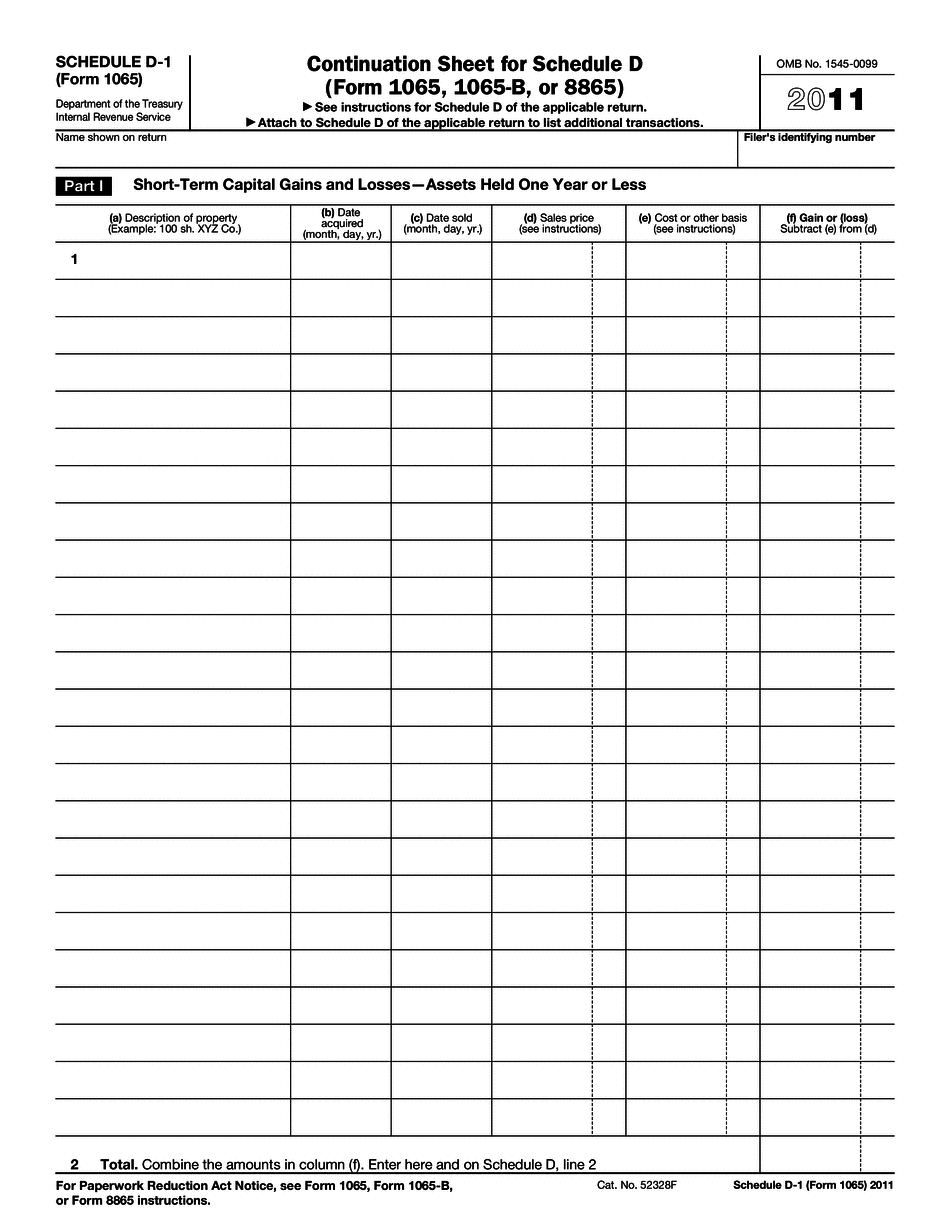

Income attributable to farm income and livestock produced (if any) from the operation of any farm business owned by the taxpayer in this state or in possession and under the control of the taxpayer, for those taxes for which payment is due on or before April 15 of the year following the tax year. Such livestock produced, if any, may include livestock not being used in the business owned and controlled by the taxpayer. All property transferred to a trust or a nonprofit corporation, or paid out of a fund, in lieu of cash or property of value, for the principal purposes of maintaining or preserving a farm, ranch, or other livestock operation; or Partnerships and multiple owner LCS. Form 1065 plus 1065 K-1 forms for each owner, Washington State does not have a personal or business income tax. Tax Forms and Publications | or — DC Office of Tax and Revenue Eligible business expenses. In general, an eligible business expense is any expense attributable to the operation of a partnership or the ownership and possession by one or more members of a multi-member LLC, to the sale of supplies, or to a loan to the owners and/or beneficiaries of a trust fund for the interest of owners or beneficiaries. The following are excluded from the scope of the rules: (1) expenses of self-employment (e.g., salary, rent, insurance, and business expenses); (2) business travel expenses, regardless of whether they are incurred in the course of a bona fide trade or business (e.g., the costs in computing and reporting the business travel costs do not include expenses paid by a party to a business trip when the other parties of the trip are not employees of the party in connection with business-related travel); (3) business office space, equipment and supplies, and office supplies and supplies, including computers, if the business operation is carried on a limited basis (e.g., the costs in computing and reporting the business office space and equipment and supplies and supplies do not include expenses paid by the owners and/or beneficiaries of a trust fund for the interest of owners or beneficiaries); and (4) capital expenditures for improvements to, or the acquisition to maintain or improve, a property by a business enterprise. Schedule D (Form 1065) — IRS Part I. Short-Term Capital Gains and Losses—Generally Assets Held One Year or Less (see instructions.). See instructions for how to figure the amounts to Part II.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete King Washington Form 1065 - Schedule D-1, keep away from glitches and furnish it inside a timely method:

How to complete a King Washington Form 1065 - Schedule D-1?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your King Washington Form 1065 - Schedule D-1 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your King Washington Form 1065 - Schedule D-1 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.