Award-winning PDF software

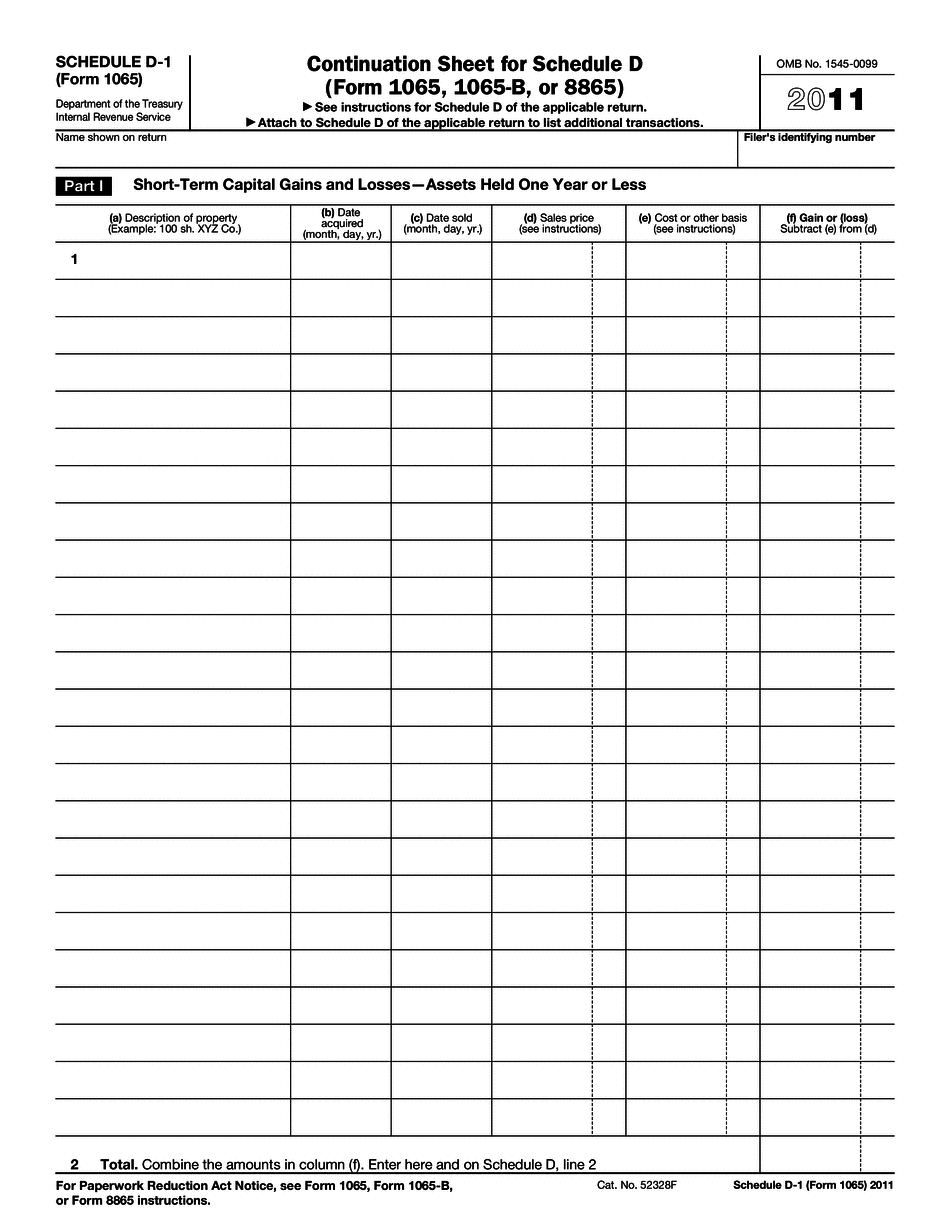

Printable Form 1065 - Schedule D-1 Nassau New York: What You Should Know

For a list of forms and schedules available in ATX, please click on 8874, New Markets Credit K1 INPUT (1065), Federal K-1 (1065) Input Worksheet. Form 1065 is used by individuals or partnerships for reporting their partnership income or loss. A domestic partnership is a partnership that forms a legal union or cohabitation, or that otherwise has legal responsibilities to each other or to a third party for all or a portion of the partners' business, property, or liabilities (for example, property and debts owing to a joint tenant by the partners and a real estate business). Generally, there are no requirements for a partnership to file Form 1065 when it uses either line 14 (other than line 14F) of Schedule K-1 (Form 1065) or lines 11, 14, 15, or 16 (other than lines 3, 4, 9-1, or 16F) of Schedule B (Form 1065) to report partnership income or loss. Form 1065 can be used to figure partner income, gain, loss, or deduction. In other words, Form 1065 can be used to determine: • Whether a partnership has been a resident of NYS the tax year; • Whether partnership income was limited to partnership income derived from New York business activity other than limited partnerships; and • Whether partnership gains or losses were limited by line 14F (other than line 14F-E or E-12) of Schedule K-1 (Form 1065). Some exceptions may apply. See New York Business Income Limits below. What does partner income include? Partnership income includes such things as income from sources within NYS or from outside NYS, interest generated from NY sources by partners, and rental income received from tenants by or on behalf of a partnership in any NYS rental property. What does partner income exclude? Partnership income does not exclude the following: • Partnership income derived from investments (other than passive investments). See IR-821 and IR-822.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1065 - Schedule D-1 Nassau New York, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1065 - Schedule D-1 Nassau New York?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1065 - Schedule D-1 Nassau New York aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1065 - Schedule D-1 Nassau New York from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.