Award-winning PDF software

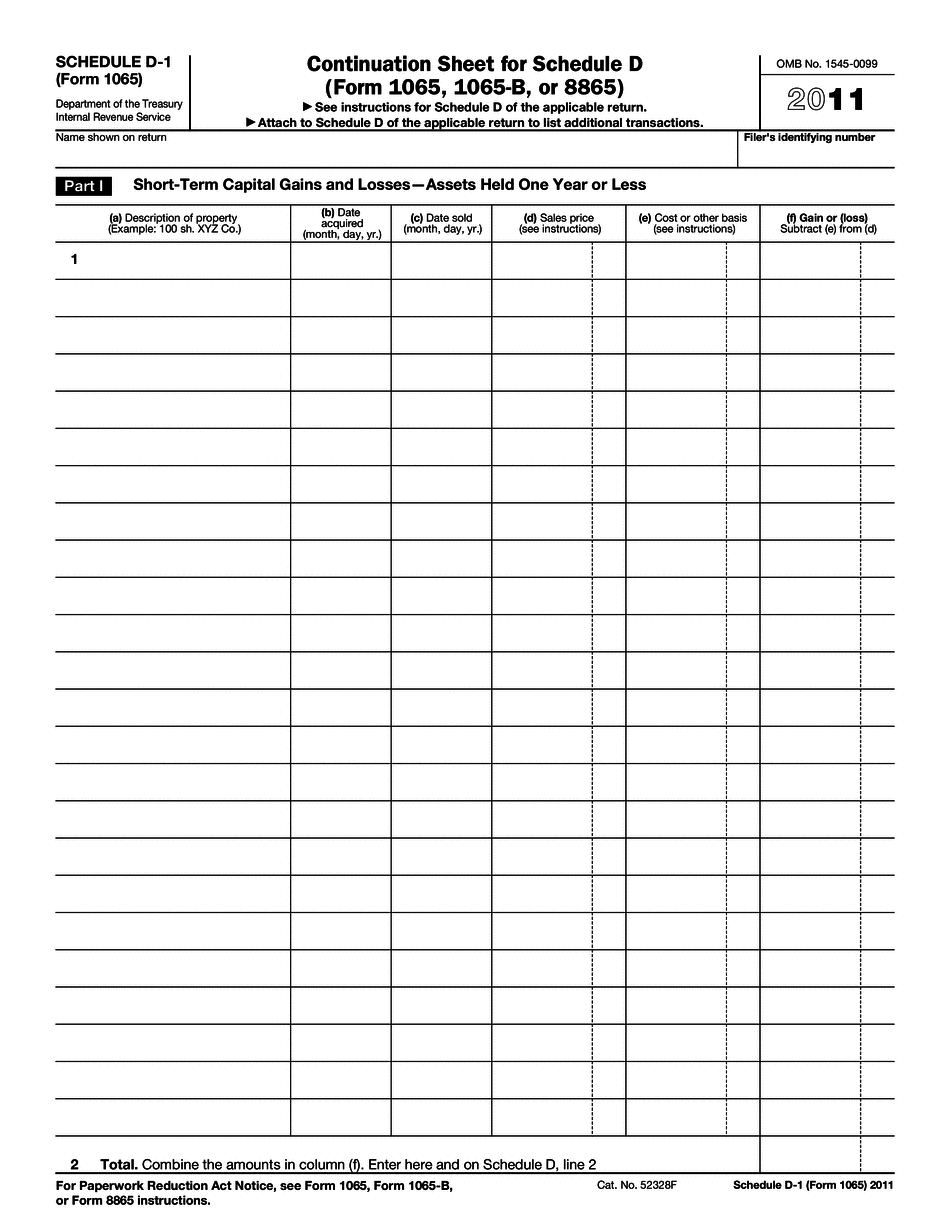

New Mexico Form 1065 - Schedule D-1: What You Should Know

Income Statement. 1085 Form Determination of Residence Status (see instructions). 2021 California Business Entities —Form 1120. Return Preparer's Guide (see instructions). In this document, prepare all tax returns from July 1, 2018, through June 30, 2020, including any prior year return filed by the business. Form 1120 is only for California businesses that have no federal withholding tax on their partnership income. However, the California Form 1120 is accepted for federal income tax withholding as an alternative to filing a federal Form 1065 for the prior year. Also, California returns and the Form 1065 filed by the business must meet all state reporting requirements, and must be signed in the name of the business. 2022 New Mexico Income Tax Return or Taxation and Revenue New Mexico Tax Certificate (see instructions). The return or certificate required must contain the following: A copy of the business' business license showing its business address; The businesses New Mexico Employer Identification Number or New Mexico Employer Identification Number (DIN), must be shown with each business name on the business' business license; and The businesses last federal Internal Revenue Service (IRS) Individual Reference Number (IRN), may be shown by the businesses New Mexico S Corporation or LLC. See California Business Taxes with tax tables or New Mexico Business Taxes with tax tables for more help, if you need it. See New Mexico Form 1120 or New Mexico Form 1120 with instructions for more information. 2022 Forms —The return includes either an individual or a business (depending on your state). The business must fill in the Tax Code, and complete the Return Template (a two-page document with three boxes in which the return is presented). Each business filing an individual return must pay the state individual income tax rate, up to a maximum of 5.75% (per each 10,000 of taxable income) at the maximum marginal rate of 6.66% (per 10,000 of taxable income) in 2018. See state tax tables for the following information: There are many tax-filing and tax-return tips on this page. We've linked to some pages below for each of those sections of the site. If you need more help, and you have ideas for new pages or forms to add to this site, please let us know by emailing us.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete New Mexico Form 1065 - Schedule D-1, keep away from glitches and furnish it inside a timely method:

How to complete a New Mexico Form 1065 - Schedule D-1?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your New Mexico Form 1065 - Schedule D-1 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your New Mexico Form 1065 - Schedule D-1 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.