Award-winning PDF software

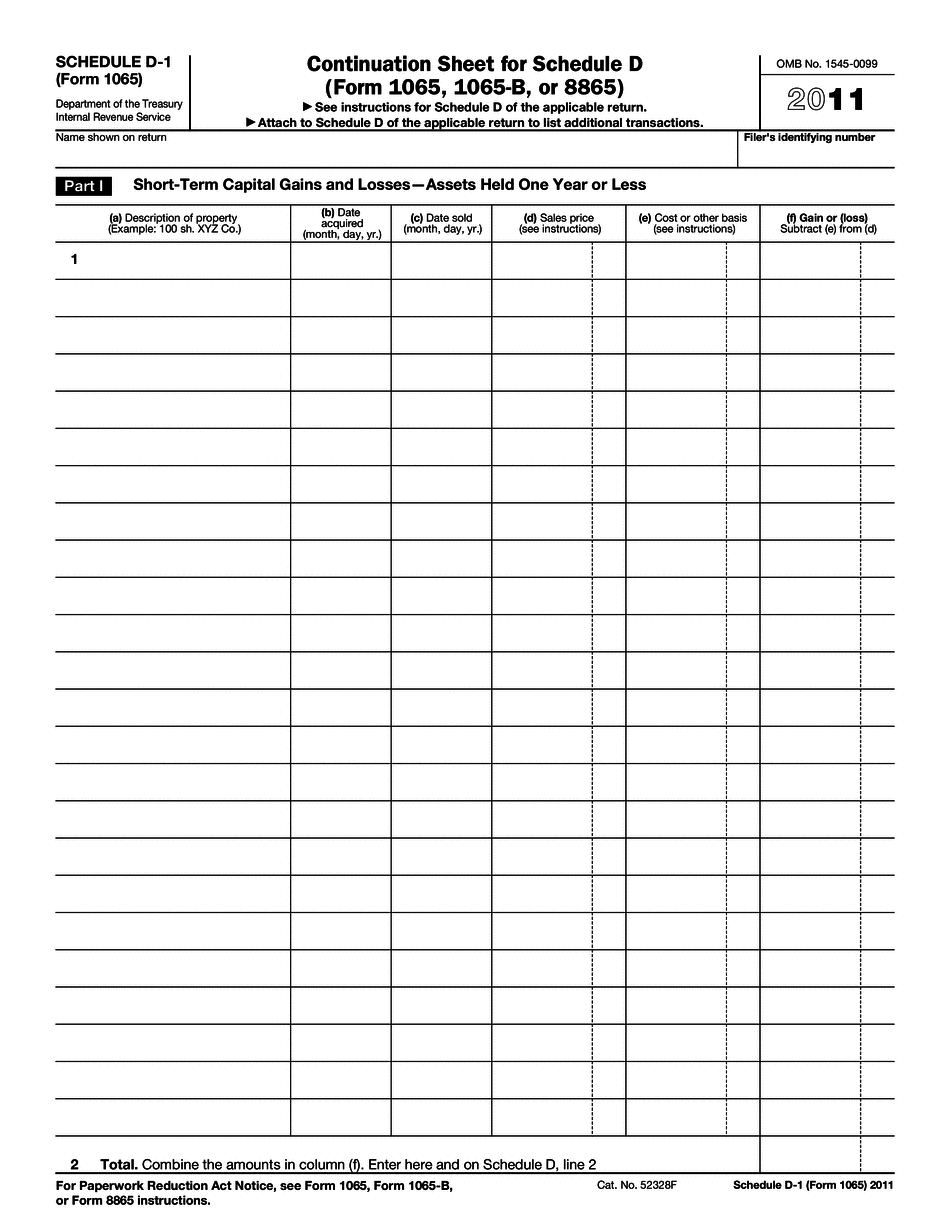

South Dakota Form 1065 - Schedule D-1: What You Should Know

State of North Dakota State Finance and Administration Division: Office of Tax and Revenue The Division administers State taxes and conducts the administrative functions associated with the collection of State and Federal taxes. The Division is the responsible administrative agency for the collection of sales, income and corporate taxes. The Division conducts extensive financial and operational audits of large, commercial companies, State agencies and entities. All of North Dakota's revenue and investment information is available online and at the Tax Department. State of North Dakota Business & Finance Division: Bureau of Corporations and Business Licenses The Division administers and conducts the administrative functions associated with the collection of commercial real estate, employment (wages and benefits) taxes, and professional taxes such as barbering, cosmetology, and manicurists' licenses. State of North Dakota Commerce and Economic Development Department: Sales Tax Bureau State of North Dakota Education and Research: Department of Higher Education The Department of Higher Education collects State and federal taxes and administers other State-administered programs that include aid to institutions of higher education. If there is any change to an institution's tax status, the Department requires each institution to comply with the changes. State of North Dakota Department of Commerce and Tourism: Bureau of General Services The Department's role is to provide the general business and tourism services to the State and provide public information and promotion to the State. The department also administers various State tax programs. State of North Dakota Education and Research: Department of Colleges and Higher Education The Department's role is to provide general business and tourism services to the State and provide public information and promotion to the State. The department also administers various State tax programs. Department of State: Budget Dos. R.S. 14:74-09 (2011) (1) Every agency, the State's agencies or a political subdivision or another subdivision of the state, and every officer, employee, agent or other representative of the state shall provide and maintain a current budget for State operations which includes a complete list of all program and project expenditures made by the department, bureau, or other subdivision.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete South Dakota Form 1065 - Schedule D-1, keep away from glitches and furnish it inside a timely method:

How to complete a South Dakota Form 1065 - Schedule D-1?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your South Dakota Form 1065 - Schedule D-1 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your South Dakota Form 1065 - Schedule D-1 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.