Award-winning PDF software

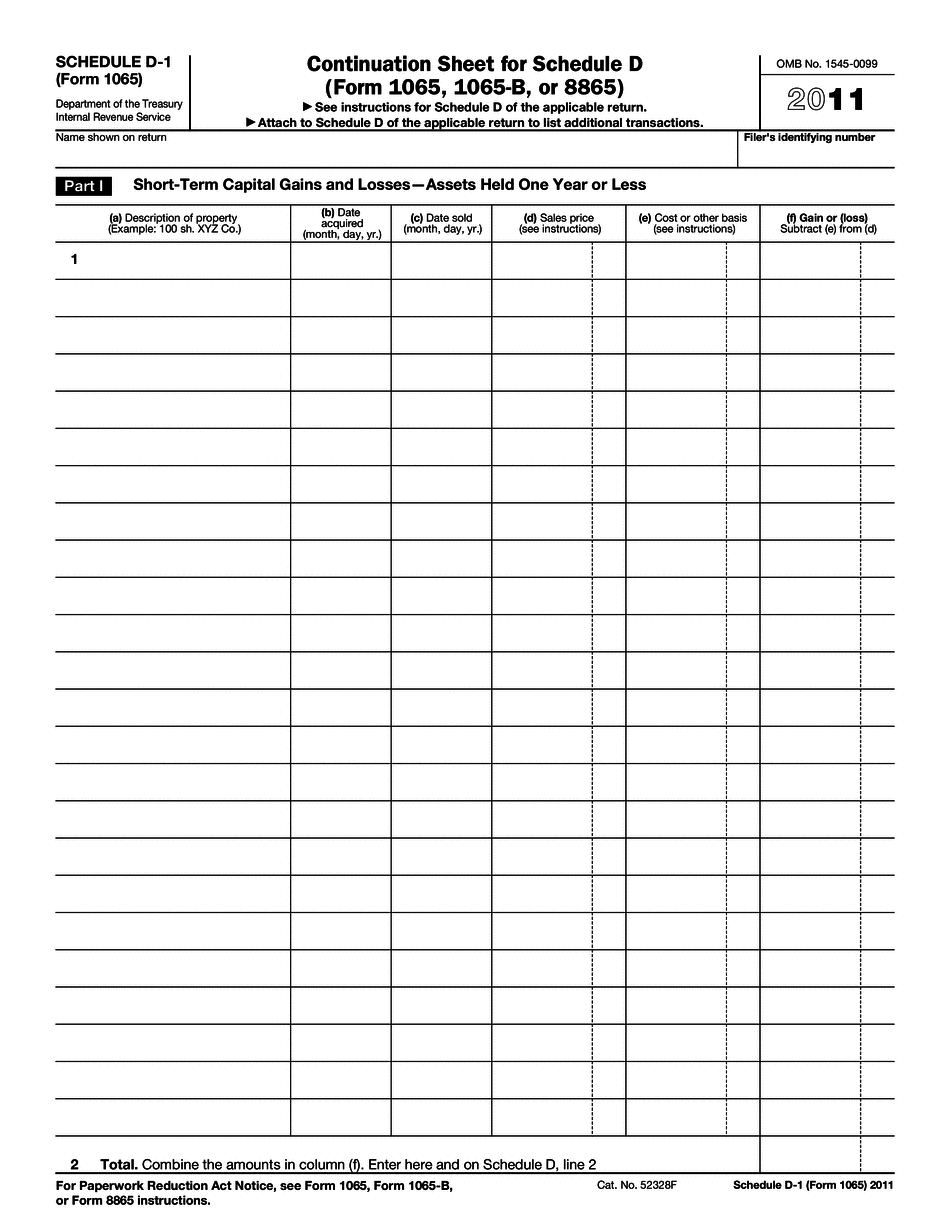

Form 1065 - Schedule D-1 California San Bernardino: What You Should Know

Form 5652, Partnership Return of Income (Gross Revenues > 25,000), 50.00; and Schedule M-1 — Only For Non-U.S. Partnership Return of Income (Per Form 8582, U.S. Non-Resident Alien Return of Income (Gross Revenues > 5,000), 2,500.00 If your business is a C corporation, see Form 55003, Partnership Return of Partnerships (Individual Return), to report the partnership fee on Schedule K. See the chart below under Schedule D, Part II; Gross Income — U.S. Schedule K (fees) Gross Income — Foreign Schedule K (fees) Total Gross Income for Foreign Partnership 0 2,000 5,000 250,000 750,000 U.S. Partnership Gross Income 25,000.00 2,500.00 5,500.00 50,000.00 Foreign Partnership Gross Income 0 2,000 5,000 250,000 750,000 Dividends and Capital Gains — U.S. Schedule K (fees) Dividends and Capital Gains Total Dividends and Capital Gains for Foreign Partnership 0 0 22,000.00 220,000.00 U.S. Partnership Gross Income 75,000.00 5,000.00 12,000.00 250,000.00 Foreign Partnership Gross Income 0 5,000 12,000 250,000 750,000 Schedule K (fees) is a list of all amounts paid or accrued as a result of the partnership. You can find the fees for Schedule K in the following table: Schedule K (fees) — In addition to the amounts listed, you may include the following: 2021 Instructions for Schedule K (Form 1065) — IRS Unexpended Rental Income from Real Property—Schedule K — Schedule K (Form 1065) — IRS. Use Form 1065 when you file a nonresident alien personal tax return. See Form 1065 — U.S. Individual Return For Business, Farm, and Proprietor Agreements for more information. Unexpended Rental Income from Farm and Real Property—Schedule K — Schedule K (Form 1065) — IRS.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065 - Schedule D-1 California San Bernardino, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065 - Schedule D-1 California San Bernardino?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065 - Schedule D-1 California San Bernardino aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065 - Schedule D-1 California San Bernardino from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.